CREATING AN OMNICHANNEL PAYMENTS EXPERIENCE FROM START TO FINISH

In the financial services, the term, “omnichannel,” is too often limited to the perspective of the retail experience. Does the consumer see a consistent experience every time they use a bank or retailers various channels – online, in person or on a mobile app.

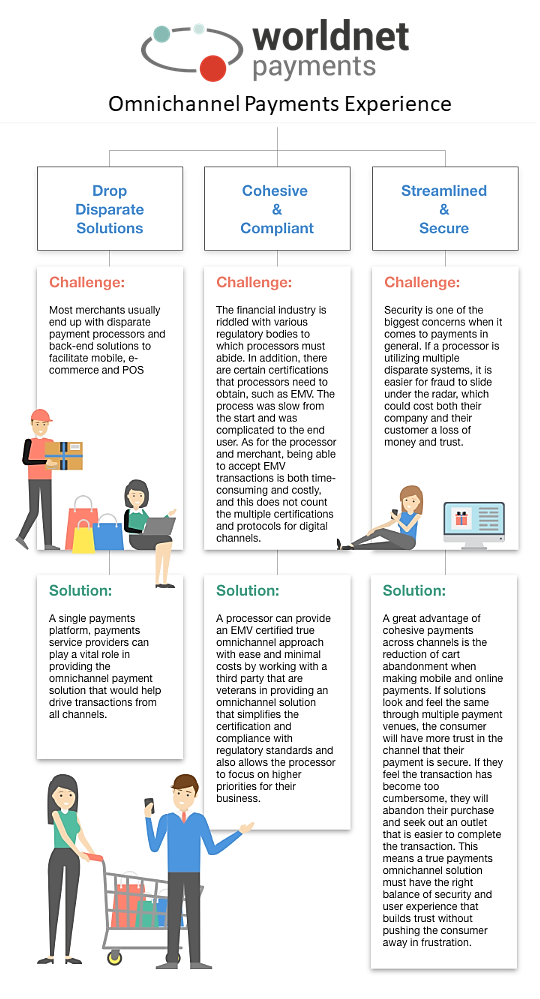

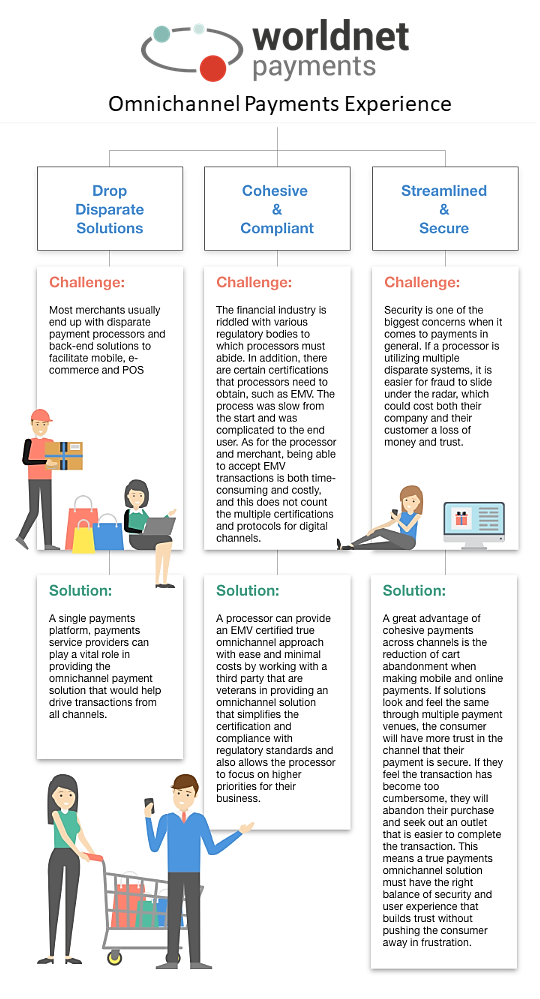

However, omnichannel in payments extends beyond a consistent user experience. True payments omnichannel also requires the back end process to be streamlined so that every payment option used is processed, protected and reconciled in the same fashion. It should not matter whether the payment is made via a mobile device or an EMV-enabled chip, payments providers are wasting time and money by patching together disparate solutions to handle every different payment source.

To provide a streamlined approach to payments, payments processors need to start from the ground up. Here are three key areas to focus on when building an omnichannel approach to payments:

Providing a great payments experience is an ongoing juggling act that should start the minute the consumer decides to make a purchase. By providing a robust omnichannel payments solution, businesses can turn their focus to the most important aspect of their businesses: meeting the demands and needs of their customers.

For more information on this or any of our other variety of solutions, please fill in the Contact form on this page and we can help you get started today!