How to Build a Payment Workflow That Saves You Time and Money

At Worldnet Payments, we do things a little differently when it comes to client services. Unlike other companies that keep their technical staff hidden away, our clients get their technical questions answered by people like me and even our CTO, if the need arises.

One of the most common conversations I have with clients is around workflows. And for good reason.

The flexibility and structure of your payment workflows can make or break the solutions you build for your merchants. At a minimum, these workflows have to function correctly. They also need to accommodate the ever-expanding universe of options end customers expect from merchants today.

The bottom line? ISVs need to custom design the transaction flows for each type of payment environment.

No Two Payment Integrations Are the Same

Every merchant must satisfy a variety of customer behaviors and expectations. The best customer experiences deliver a checkout process that features a seamless payment process. The goal is for customers to walk away from every experience thinking, "That was really easy."

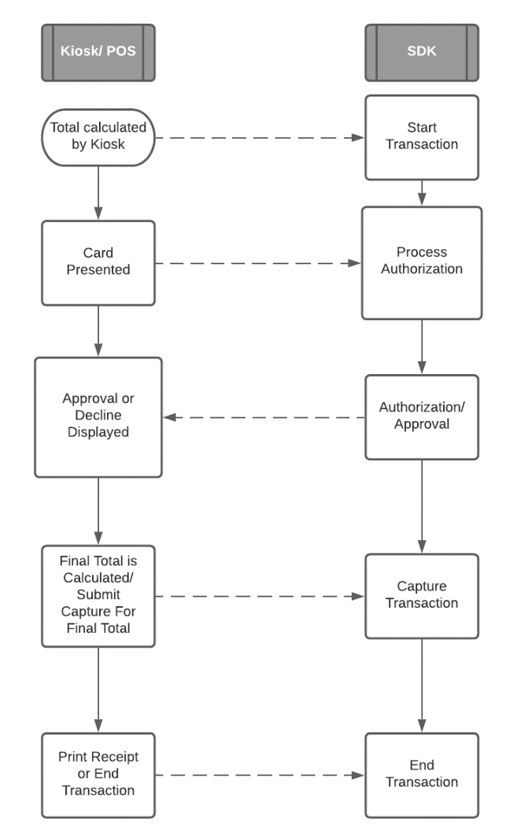

Let’s look at an example of the simplest workflow: A one-time sale at a kiosk.

Standard Payment Workflow

The most basic payment workflow for a one-time sale might look like this:

- The customer makes a purchase, which initiates the workflow.

- The payment partner initializes the payment and sends a total to the SDK.

- The SDK takes the total and communicates directly with the device, which manages all PCI compliance for the merchant.

- The gateway then manages the payment by communicating with the acquiring bank to receive an approval or a decline.

- Transaction information (such as an approval or decline code, the last four digits of the card number, or other details that can be shared with the merchant) is sent back to the system for tracking.

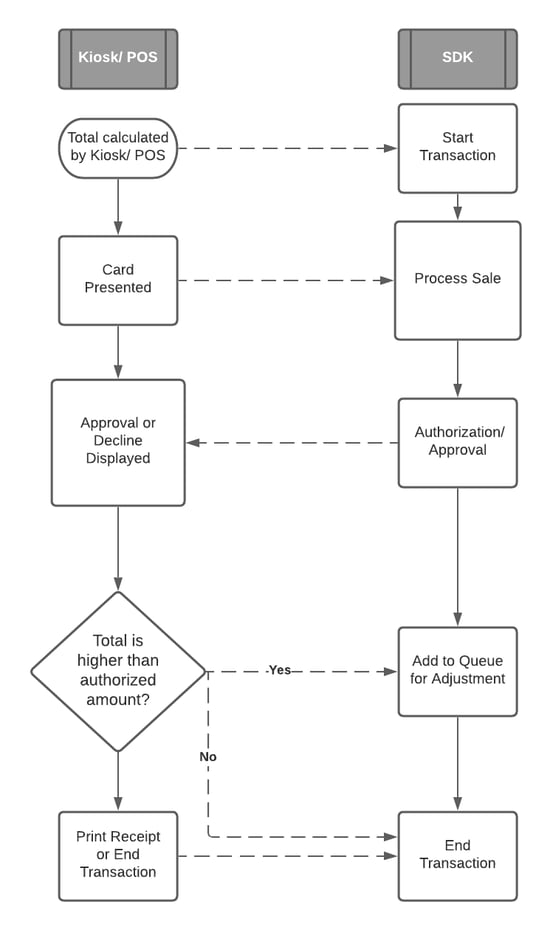

Adjustment Payment Workflows

In reality, not every transaction is this straightforward. Customers might forget to add an item to their cart, or they want to add a tip for a server. Similarly, merchants might want to offer a discount to sweeten the deal or encourage customers to include those last-minute impulse buys.

To accommodate all this, your payment workflow will need to allow for adjustments.

Say a customer is ordering lunch at a kiosk. Their payment is processed and approved, and the kiosk serves up an ad offering the customer apple pie for an extra dollar. The pie is normally $2, so the customer decides to take advantage of the discounted offer. This payment flow will need to add the extra dollar before settling or closing out the transaction.

For scenarios like this, I recommend starting with a standard workflow that includes the initialization through approval. When the customer initiates the secondary transaction, the SDK sends an updated transaction call to the gateway indicating the adjusted settlement.

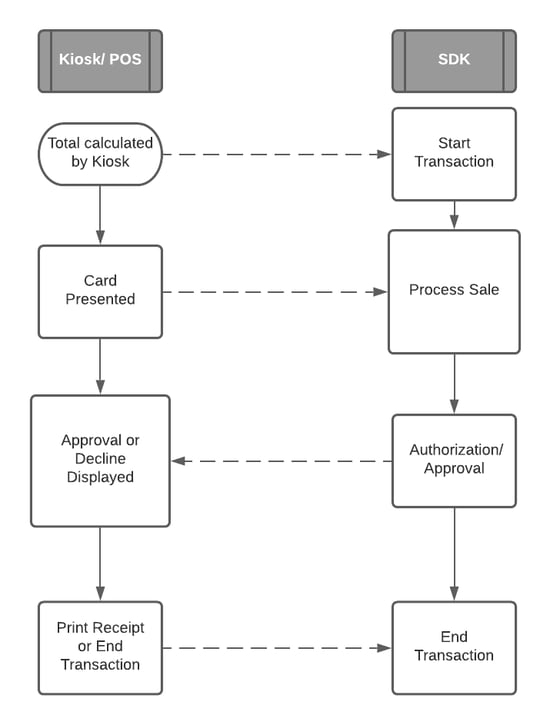

Offline Payment Workflows

What happens when a merchant kiosk doesn’t have internet access? For example, unattended payment devices might be situated in remote locations, such as RV parks or other sites with low power or where connectivity is satellite-driven and outages are frequent.

For those situations, I recommend a payment workflow specifically designed to handle transactions when devices are in offline mode.

As shown in our diagram, this workflow includes a step that checks to see if internet access is available. If it’s not, the kiosk/POS holds the payload until internet access can be established. From there, the transaction workflow continues as usual.

Obviously, for these payment workflows to be set up properly, you need to consider a number of factors.

Factors That Influence Workflow Structure

When we work with ISVs to help them structure payment workflows to fit the solutions they’re designing, we ask a lot of questions:

- What device are you using?

- What operating system do you have?

- In what environment will the SDK live?

- What programming language are you using?

- What is the physical environment where the payment solution will be located?

- Will the payment involve a cardholder or point of sale system?

- Will the payment need to be self-service or unattended, such as a kiosk in a restaurant, laundromat, parking lot, car wash, etc.?

- Will you need to facilitate tokenization?

How an Omnichannel Payment Gateway Partner Can Help

Setting up these workflows can be complex. This is where the value of a true omnichannel payment gateway partner really shines.

Experience in Unattended Environments

Self-serve and unattended environments are becoming increasingly popular among consumers today, but not all payment gateways have extensive experience in unattended and contactless environments. If you’re not working with a gateway partner capable of building true omnichannel solutions, you’ll instead be forced to patch together a fragmented series of disconnected solutions. This is inefficient and potentially costly for you, and often leads to disjointed customer experiences for your merchants.

However, an experienced omnichannel partner like Worldnet Payments can provide a solution that is not only seamless but also designed specifically for unattended and contactless environments.

For example, merchants with multiple locations (such as car washes or parking lots) often foster customer loyalty with membership cards that allow their customers to upload payment methods or even establish prepaid balances on their accounts. When the customer conducts a transaction and swipes their membership card, they expect that the merchant will recognize them and will apply the transaction to their account balance. In these situations, we are able to tokenize these cards and deliver a seamless experience that results in happy, satisfied customers for your merchants.

Adaptable for Growth

You’re in business to succeed and grow, which means taking on more merchants. However, each of these merchants will have unique business models. How will you incorporate new types of payment environments to facilitate this growth?

To easily build payment solutions that meet the needs of any payment scenario, you need a partner that has already mapped out those workflows.

We have the flexibility to change and enhance your existing workflows both now and as new technologies and payment options become available in the future.

Rigorous Compliance & Extensive Certifications

The Worldnet platform meets the highest certification standards to help reduce your compliance burdens and to keep your payments safe and secure. We’re Level 1 PCI DSS Compliant (the highest and most stringent of the PCI DSS levels) and offer an end-to-end certified solution using any of our supported devices and payment methods. You can rest assured that you can store, process and transmit payment data securely with our Level 3 EMV certified SDK.

This level of security comes with the ultimate flexibility and access to a wide range of pre-certified payment devices and the most popular acquiring processors. Choose devices from ID TECH, Ingenico, BBPOS, PAX and in 2022 we’ll be adding Castles payment terminals to the mix. Our team ensures rigorous compliance and an extensive portfolio of certified devices for your convenience.

Superior Customer Experience

By working with one payment gateway partner that takes a holistic, omnichannel approach, you’re ultimately able to build the best solutions that deliver the superior customer experience that merchants (and you) can count on.

This superior customer service applies to your business as well. Whether your merchants have a point-of-sale system, eCommerce, gift cards, or a mobile app for buy online/pickup in store (BOPIS), each of those options represent different payment paths – and they can all be handled with a single gateway solution. That means one number to call when there’s a problem, one system for your accounting team to access for remitting invoices, and one place to monitor, manage and track transactions.

At Worldnet Payments we’ve built transaction flows for virtually every scenario and every payment type and can help you create whatever you need for your solutions. If you’re interested in finding out how our team can assist you in choosing the right payment workflows, reach out to us. We’d love to help.